What 18 Top Economists Say About US Home Values in the Months to Come

High interest rates and historically low inventory have plummeted buyer demand to the lowest levels in 22 years according to recent data from MBA. With home values continuing to reach all time highs even in the face of listing price reductions, both buyers and sellers are left wondering what’s in store for the future of housing appreciation.

In order to provide diverse analysis, we’ve rounded up quotes from the top economists in the country. If you’re just wanting the TLDR (too long; didn’t read), their reactions could be summarized like this: barring a few outliers, most economists project home values nationwide to continue to increase, but at a much slower rate than 2021 and early 2022.

Let’s take a look at what their thoughts are in regards to home values in the coming months.

Mark Zandi, chief economist at Moody’s

“Home prices will go flat nationwide, [along with] price decline in the most juiced markets in the South and West.”

In a recent CNBC interview, Zandi says we’re nowhere near risking any crash like in 2008, due to inventory being at a record low. “This is the exact opposite of the situation during the 2007-2008 housing bubble when vacancy rates were at a record high. Building supply will increase as supply chain issues iron out. Inflation has peaked [and] will be meaningfully moderating by this time next year.”

Will home prices fall in the coming year?

No, according to Zandi. Instead, he predicts a "housing correction," with, at most, 5% to 10% price reductions in more “overvalued” housing markets like Boise and Charlotte.

The TLDR: Unlike in 2007-2008, low inventory will prevent prices from falling.

Lawrence Yun, chief economist & senior V.P. National Association of Realtors

“Home value appreciation will start to slow down.”

Pointing to the recent five-month drop in the amount of pending home sales, Yun projects that the current high mortgage rates will continue to slow the housing market.

In a June 3rd, CSPAN interview, Yun stated that “mortgage rates may be topping out right now.” Additionally, “home prices are rising 20% at a time when incomes are only rising 5%. That’s not sustainable. So some degree of calming is to be expected.”

Which market is currently the hottest?

According to Yun, “the Rocky Mountain time zone area. Super hot. Along with southern states.”

The TLDR: Home prices won’t be rising as much in the coming months.

Daryl Fairweather, chief economist at Redfin

“I don’t think home prices will go down.”

Quoted May 31 in Marketwatch, Fairweather shared the sentiment of many economists who believe that home prices will not be dropping. In fact, in a recent Pulsenomics survey, only 20% of the economists questioned think home prices could decline over the next five years. In fact, she says that popular Sun Belt communities will likely experience continued price growth. However “buyers in markets like Los Angeles, San Francisco, Boston and Seattle who have lost out on several bidding wars may find they’re facing less competition from other buyers than they were a month or two ago.” Additionally, they may be “relieved to know that the double-digit year over year price growth we’ve been experiencing is likely to drop into the single digits in the coming months.”

The TLDR: Home prices won’t drop, but the rate of increase will be slower.

Nadia Evangelou, economist and director of forecasting at the National Association of Realtors

“I believe the housing market will continue to outperform compared to pre-pandemic.”

In a June 9th Twitter post, Evangelou tweeted: “Although mortgage rates will continue to rise in 2022, don’t expect to see the same sharp increases that the market experienced in March and April. Mortgage rates will likely average 5.6-5.7% by late 2022.” Still, “housing demand should slow down due to weak affordability.”

Though home sales have declined in the last three months, “due to seasonality trends, I believe the housing market will continue to outperform compared to pre-pandemic. Keep in mind that June is traditionally the busiest month for the real estate market,” she concluded in a June 6 interview on Bankrate.com

The TLDR: Housing demand will slow, but home values will continue to rise.

Enrique Martínez-García, senior research economist at the Federal Reserve Bank of Dallas

“The continued mismatch between housing demand and supply makes it unlikely that slowing would actually cause home prices to drop over the coming year.”

Though Martínez-García made headlines for telling Fortune, “This might be a housing bubble,” he proceeded to walk back the dire prediction in later statements indicating that high demand and low inventory would keep housing prices from crashing or even dropping. Adding that he expects home prices to realistically continue to rise slightly over the next 12 months.

The TLDR: Home values will continue to rise.

Selma Hepp, deputy chief economic for CoreLogic

“The market will continue to see relatively strong demand from buyers and an elevated rate of home price growth, despite slowing notably from ultra-hot early spring 2022 conditions”

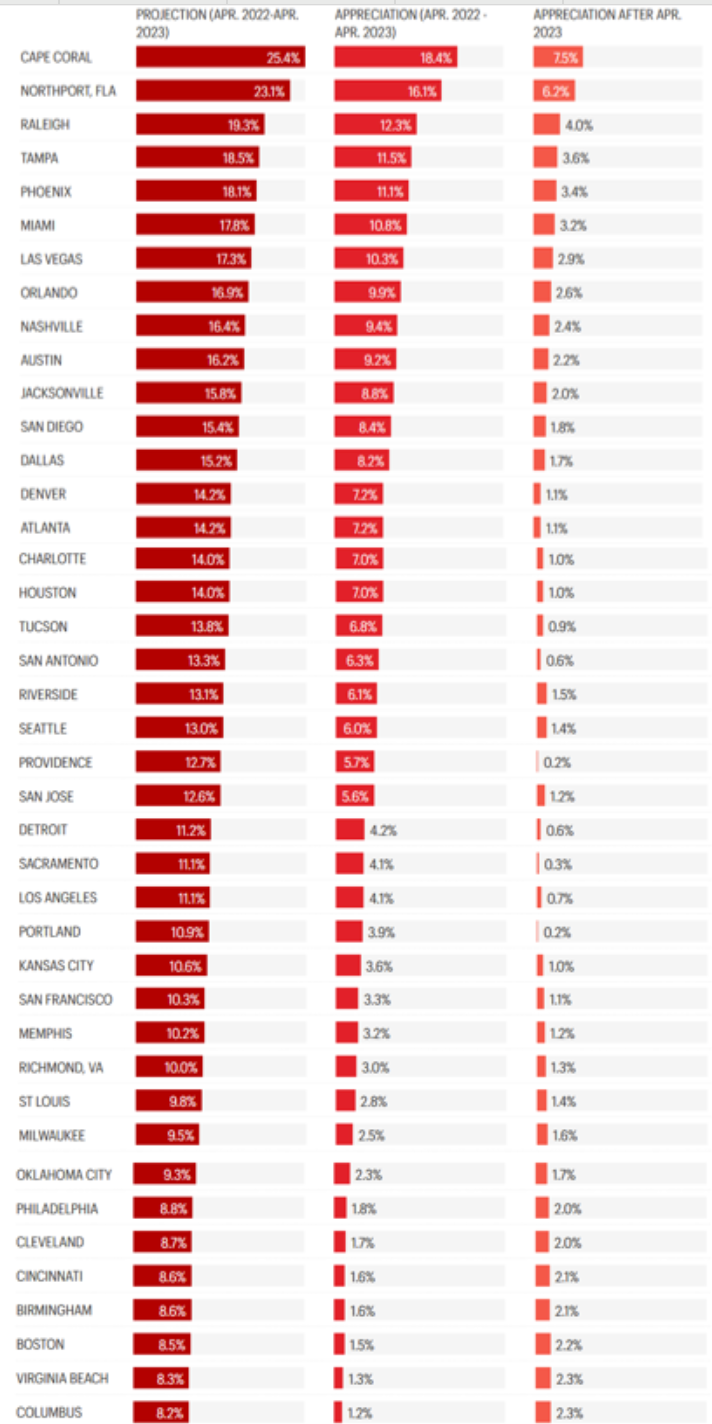

Earlier this week, Hepp told Bankrate that home values will continue to appreciate while demand remains strong. In fact, a recent forecast from Corelogic projected that home prices will continue to increase 1.2% on a month over month basis, but “annual U.S. home price gains are forecast to slow to 5.6% [year-over-year] by April 2023 as rising mortgage rates and affordability challenges impede buyer demand.”

The TLDR: Home values will rise.

Greg McBride, chief financial analyst for Bankrate.com

“We will still see home price levels that are 15 to 20 percent above what a home would’ve sold for six to 12 months ago.”

Noting supply issues and cooling demand, McBride stated, “while the market is cooling, prices are not necessarily dropping.” He reiterated the thoughts of many others: That even as “demand is falling off sharply due to soaring prices and higher mortgage rates” low inventory and buyer demand that still continues to outpace that inventory will keep prices rising even as demand and inventory begin to moderate.

The TLDR: Demand is decreasing, but prices won’t drop.

Ken Johnson, economist at Florida Atlantic University

“If we’re not at the peak of the current housing cycle, we’re awfully close.”

Some are saying those Rocky Mountain time zone regions that, earlier in this article, Lawrence Yun had indicated as being the “hottest,” may be overvalued. Ken Johnson says the Denver and Colorado Springs markets may be overvalued. “Recent buyers in many of these cities may have to endure stagnant or falling home values while the market settles – and that’s not what they want to hear if they had planned to resell anytime soon.” He projects that there may be a slow down, especially in these regions. “Near-record-low mortgage rates helped fuel demand for housing, especially during the pandemic, and the competition for homes pushed prices higher,” he said. “But now the Federal Reserve is raising rates to curtail inflation, and already that’s cooling demand.”

The TLDR: Home values may flatten and even fall in overvalued markets like Denver and Colorado Springs.

George Ratiu, senior economist and manager of economic research for realtor.com

“While sellers are expected to hold the upper hand in 2022, navigating the listing process remains a challenge.”

Discussing the trend of sellers planning to list their homes at the end of summer, Ratiu says “many buyers remain interested in finding a home. At the same time, recent housing trends suggest demand is beginning to moderate as higher mortgage rates push monthly payments out of some buyers' budgets, underscoring the long-term need for more affordable inventory." It’s important, Ratiu says, for sellers to be aware of “market conditions, prices and seasonal trends” as demand won’t be as booming as it was prior to the interest rate hike.

The TLDR: Home values will moderate. Marketing will be more important.

Ed Pinto, director, American Enterprise Institute’s Housing Center

“We’re seeing a big migration from pricy markets such as San Jose or New York to Charlotte, Boise, or Phoenix.”

In a June 6 interview with Shawn Tully, Pinto says “we’ve seen a 33% increase in the price of similar homes since January of 2020 that has no precedent in recent history. But the fall from 17.3% to 14.2% appreciation is enough of a change to call an inflection point. That inflection point marks a major reversal, the start of falling HPA in future months.” Still, he says a seller’s market will remain for now, adding it would take a rate hike of 6-7% to majorly cool the market. Referencing the work-from-home revolution that has led to populations leaving extensive coastal metros, Pinto says “That housing arbitrage opportunity is driving up prices in the mid-to high end on the inexpensive markets. And that trend has staying power.”

The TLDR: Home values will continue to increase, more-so in previously inexpensive markets.

Len Kiefer, deputy chief economist at Freddie Mac

“The U.S. housing market is at the beginning stages of the most significant contraction in activity since 2006."

In a recent tweet, Kiefer expresses concern about how the rate of “mortgage applications are pointing to a large decline over summer.” Adding that “purchase apps [are] down 40% from seasonally adjusted peak.” Further, he explains, “during COVID in spring of 2020, applications also fell 40% but came roaring back in short order. Such a rebound is unlikely in the current environment. But neither is the very very slow recovery we saw in 2011.”

Additionally, this contraction is unlikely to result in decreasing home values. Freddie Mac projects home prices will continue to grow 2.2% in Q3 with the rate dropping slightly to 1% appreciation by the time we get to Q2 in 2023.

The TLDR: Home values will continue to increase.

Douglas Duncan, chief economist at Fannie Mae

“Home sales will slow meaningfully through the rest of this year and into next.”

Citing a recent survey showing record-high pessimism from would-be homebuyers about mortgage rates and high home prices, Duncan projects these factors “will likely continue to squeeze would-be homebuyers” and dissuade potential sellers who want to hold onto their low mortgage rate.

Fannie Mae’s forecasting indicates that this combination of reduced demand and reduced inventory will result in housing prices continuing to rise through Q2 of 2023 though at a slower rate than previous months. By Q4 of 2023, values will still be appreciating 5.4% month-over-month according to Fannie Mae’s projections.

The TLDR: Despite (or perhaps even because of) conflicting economic factors, home values will continue to increase.

Nicole Bachaud, economist at Zillow

"Unlike in 2006, this market is underpinned by strong fundamentals and has been built on mortgages with sound credit, factors that won't change in the near term."

Responding to the results of a recent Zillow survey that found nearly 60% of the more than 100 housing experts believe the housing market is not currently in a bubble, Bachaud stated "Americans have seen home values rise at record rates over the past few years. But although a recession is looking more and more likely, the housing market today is a far different beast than what we saw in the mid-2000s.” Since most of the experts polled believe that a recession will begin in either 2022 or 2023, Bachaud added that such an event would likely strengthen consumer’s real estate. Housing, she adds, has historically enjoyed “relative stability as an asset.”

The TLDR: Home values will continue to increase.

Andy Walden, economist at Black Knight

“Low inventory provides a backstop for home prices.”

In a June 1 CNBC interview, Walden says: “We could still see significant pullback. There are still major headwinds there for the purchase market. One of them is rising interest rates and the fact that they’ve now driven the lowest level of home affordability that we’ve seen since 2006. And the second is that we still have only one third the level of housing inventory than what we traditionally should.” Lack of affordability and inventory continue to put downward pressure on the housing market. That will likely carry through the summer months. Though sales activity will decline, Walden insists there will not be a drop in prices.

The TLDR: Home values will not decline.

Ali Wolf, chief economist at Zonda

“While demand has softened, there are still more buyers than sellers given the acute lack of inventory.”

In a June 8th tweet, Ali Wolf expressed surprise at a certain finding in the Pulsenomics survey. “I'm sure I'll get some flak for this,” she said. “But I'm utterly shocked that only 20% of economists in the Pulsenomics survey think home prices could turn negative over the next FIVE years.” Such sentiment indicates she suspects values might drop in that time period. Her statements in a recent Fortune interview, however, are more tempered. Due to the low ratio of inventory to potential purchasers “the shift that we're seeing so far isn't catastrophic.”

The TLDR: Mixed, bordering on pessimistic for home values in the next 5 years.

Danielle Hale, chief economist at Realtor.com

“...market conditions continue to favor sellers.”

“Today’s data offer a hint of relief on the horizon, though a very distant one,” Hale says in an interview for Marketwatch. “With more options, home shoppers may see a bit more negotiating room and time to make decisions.” In her weekly housing trends report for Realtor.com, Hale noted “The median listing price grew by 16.9 percent over last year.” Additionally, “the typical home asking price is still advancing about three times faster than it would in a normal market, so it will take much more inventory to see a meaningful slow down in home price growth.”

The TLDR: Home values will rise unless a great deal of new inventory suddenly enters the market.

Ian Shepherdson, chief US economist at Pantheon Macroeconomics

"The housing market is in the early stages of a substantial downshift in activity, which will trigger a steep decline in the rate of increase of home prices, starting perhaps as soon as the spring," Shepherdson told Business Insider. Shepherdson projects monthly sales to total 4.5 million by the end of the summer, down 1.5 million from February sales. “Prices recently have increased much faster than implied by the inventory numbers, perhaps because the shortage of inventory of existing homes has pushed up demand for new properties, [but now] they are starting to correct. This process has much further to run." Shepherdson goes on to predict that home values are vulnerable to decline in the coming months, but this drop will not be drawn-out. Rather, it would look more like a dip as consumers and sellers adjust to the shifting dynamics.

The TLDR: A possibility for a near-term drop in value.

Logan Mohtashami, lead analyst for HousingWire

"Everyone should embrace higher rates to cool off this madness, and hope inventory rises.”

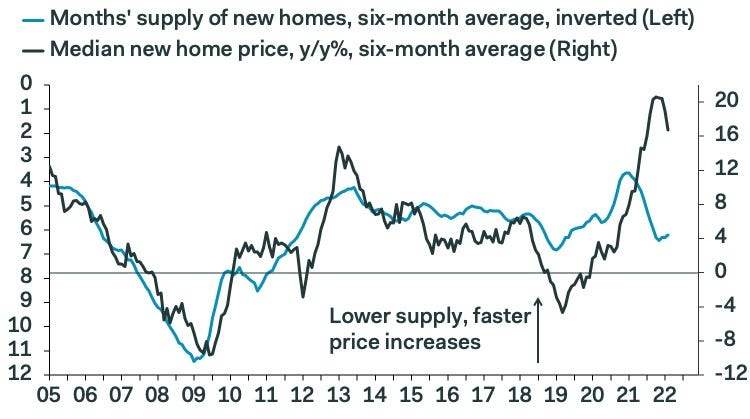

Criticizing the “savagely unhealthy” housing market, Motashami says it’s unlikely there will be price drops anytime soon. In order for home values to decline, Mohtashami wrote on HousingWire that “key data lines that need to happen first: monthly supply data getting over four months with some duration and total inventory levels getting back into a range of 1.52 -1.93 million. Until that happens, don’t look for anything big in terms of price declines as total inventory and a monthly supply of homes are just still too low.”

The TLDR: Home values will be unlikely to drop.