Cartersville/Bartow County Housing Market for Year Ending 2024

Bonnie's Takeaways

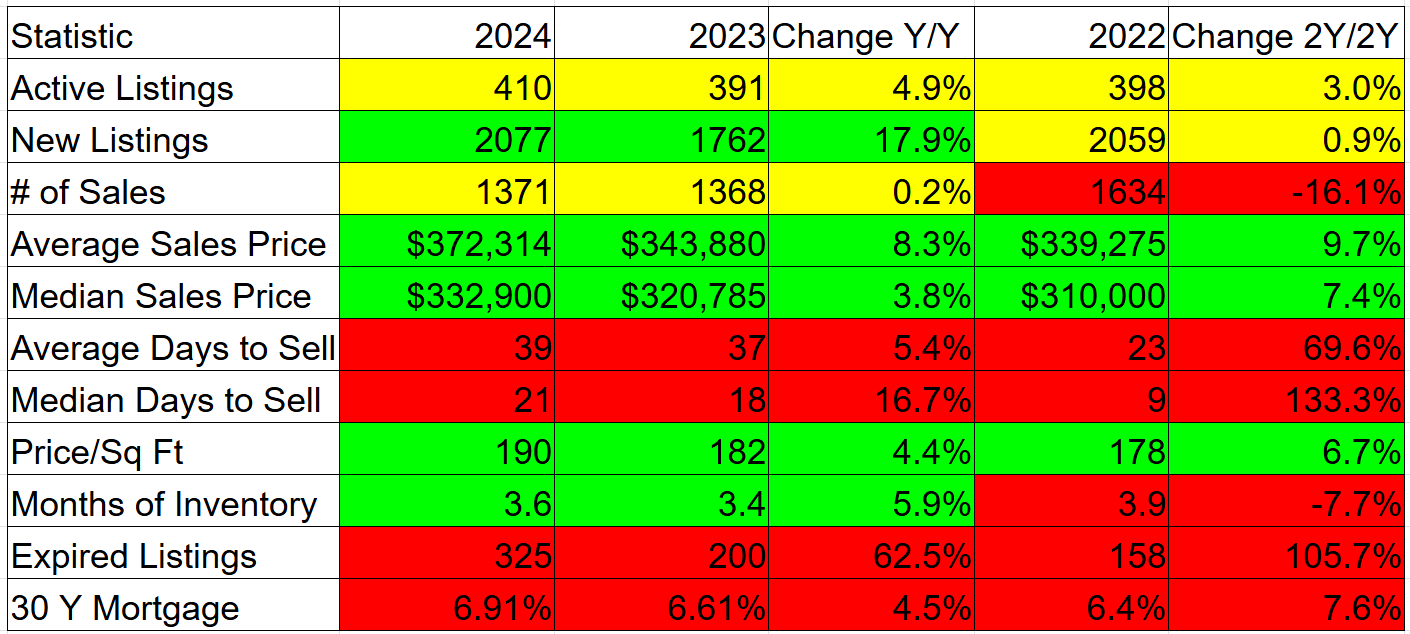

Homes in Bartow County over the long term have typically increased about 4% a year in their value. Last year in 2024 the Average Home Price rose 8.3% to an average price $372,314. I don’t actually believe the Average Home Price is the best indicator of home prices as it only takes a few high prices home sales to change the average a good bit. I prefer using the median home price which is less volatile. So to explain a little better, the Median Home Price is where 50% of homes sell below and 50% of homes sell above this price. The Medium Home Price rose 3.8% to $332,900. This puts us very close to our historical home value appreciation. If you are a Luxury home owner however, your market was a little better. If you are curious about your home’s value, don't hesitate to give me a call for a full analysis of your market.

So as everyone knows, the big impact on the housing market last year was higher mortgage rates. The vast majority of mortgages over the past decade have been under 4% while it now hovers in the mid to high 6’s. It has been an incredible run of low interest ever since the housing bust in 2008. And if you were lucky enough to get one of these low interest loans, you are now in the position of not really wanting to give it up. We only saw a .2% increase in the number of homes that sold. However, there was an increase of 17.9% of homes going on the market as more people need to move for jobs, downsizing, etc.

We are seeing a return to a more balanced market as more homes are staying on the market longer. Rarely are we seeing now multiple offers, homes selling in 1-2 days, and selling for more than list price.

Mortgage rates started the year at 6.61% and finished 2024 at 6.91%... about ⅓ of a point higher. Attention buyers! Experts do not expect the interest rates to fall much lower until sometime in 2026. Even though these rates are not historically high, this is the new norm for Interest rates. If you look historically since 1971, the average mortgage rate since then has been 7.74%. What we are seeing now is a return to those historical norms or averages.

We also saw a slightly longer market time it takes to sell a home. The big change is the number of expired listings grew over 62% and over 50% of listed homes had to reduce their asking price. Attention Sellers! Be Aware to price your home to market prices.

So just to summarize all of this, what we saw last year was a continued move to return to a normal or balanced market. What we have been used to has been historically low interest rates, historical rises in home values, multiple offers and very fast sales. 2023 and 2024 saw the inevitable return to a more normal market.