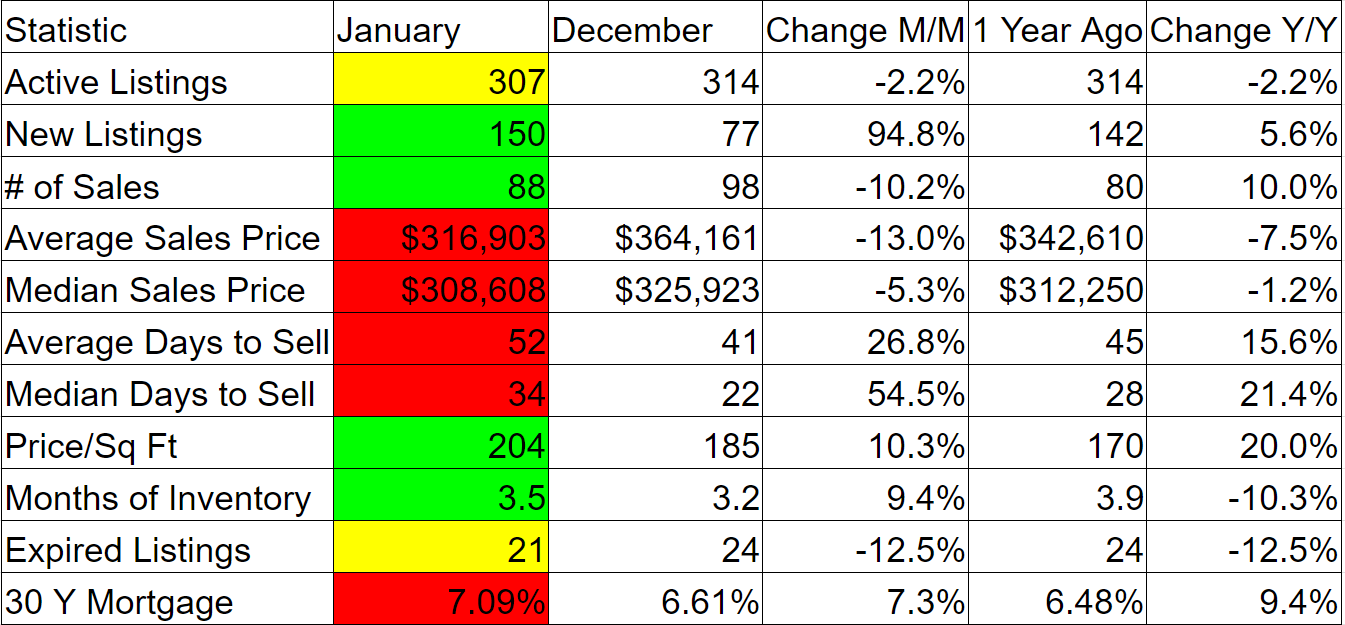

February 2024 Housing Market Report

Bonnie's Takeaways

Another new year is here and we expect a much more normal housing market this year. Median home prices are slightly down 1.2% from this time last year. I don't see that as a coming trend as there was a lack of home sales over $750,000 this month which caused the number to drop. Good news for Buyers as the number of new listings rebounded from a low in December of 77 back to a more normal rate for January of 150. Even though the number of total active listings is staying rather constant at 307, the time it takes to sell a home rose 21.4% to a median of 34 days and an average of 52. Sellers can expect longer times to sell vs what they have been used to for the past 3 years. A word of caution to Sellers, buyers can be more choosy now and overpriced homes and homes in need of repair are staying on the market much longer and requiring larger and larger price reductions to sell. Sellers need to pay close attention to comparable homes that are on the market and which ones are selling and which ones are not. It is still a seller’s market but we are moving towards a more balanced and historical average market this year and well into 2025. Be wary of fear mongering and sensational headlines of doom and disaster. It is just not in our local foreseeable future. Interest rates are slightly higher than last month and last year. The market expects rates to drop moderately beginning mid summer and slowly dropping into 2025. Don’t expect large drops anytime in the foreseeable future as rates should settle in at more normal rates in the high 5’s to 6’s . Don't make your family suffer waiting on the perfect time. If you need to make a move for your family as your needs for housing have changed, go ahead and make the move. You can always refinance when interest rates drop.

.png)